Degrees to which wealthy people depend on their stock portfolio varies, but market conditions influence most of their net worths significantly, meaning an ever-increasing stock market equals ever-increasing wealth for them. Even those who own well run businesses would likely see a significant decrease in the value of their assets if the stock market were to crash. Most would still be rich enough to get by in the aftermath, but many would be bankrupted. This leads to the most powerful people in the world having a vested interest in the market continuously setting new highs, which requires population growth, which is most easily accomplished through immigration.

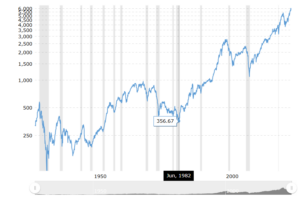

Their success can be seen on charts going back to the Great Depression, as the market has done nothing but go up for over forty years:

Inflation-adjusted chart of the S&P 500 going back to 1927

Not inflation-adjusted

The last period that was called a bubble was the late 1990s, which peaked in 2000 and deflated for a few years thereafter. But looking at these charts, it appears as though that period may have just been a blip within a much larger cycle. The S&P is roughly four times higher than when it was at the peak of the last bubble. That may have been twenty-five years ago, and that measure was taken from the not inflation- adjusted chart, but the inflation-adjusted chart shows a market that from 1982 to now has seen a seventeen-fold increase. Does the average person have a standard of living that is seventeen times better than people did in 1982? How about ten times better than 1990? All such multiples are ridiculous as the standard of living has decreased, unless you’re wealthy.

Whether markets take a leg higher, or if the last few months was the blow-off top, we could be approaching a point from which markets could take a multi year slide as this multi decade bubble deflates a bit. If the population began to decline, the market would price that in, meaning lower earnings would be expected, meaning corporations are less valuable, meaning the stocks rich people own will not be worth nearly as much.

A stock market crash would be very bad for the investor class in a high immigration environment, but it would be catastrophic with a declining population. Immigration has been used to pump this multi-decade bubble, and they would like to use it to soften the blow, and engineer a quicker recovery. Or they will keep immigration as high as possible to keep inflating the bubble. The fact that a side effect of their wealth and its preservation is the common person suffering cultural and economic rot does not matter to them, so we should not be concerned if they are forced to sell their mansions at a discount when we reverse the process.

Sending home people who make communication difficult, who make taking pride in our own cultures difficult, who make paying rent difficult, and who make negotiating a fair wage difficult would be very good for our people, but a disaster for those who rule us. Demanding a real conversation about race, and about who we are obligated to support, and what type of life the average White person is capable of and entitled to, is the only way to take back control of our countries. If people understood how badly they were being ripped off, the elite would have to negotiate for fear of a revolution.